Title: “A Renaissance in IP Asset Management: Building A Better Mousetrap”

Registration link: click here!

Speakers:

David Van Wie, Founder & Chief Investment Officer, Aventurine Capital Group, LLC

Stan Hanks, General Partner, Technology, Aventurine Capital Group, LLC

Description:

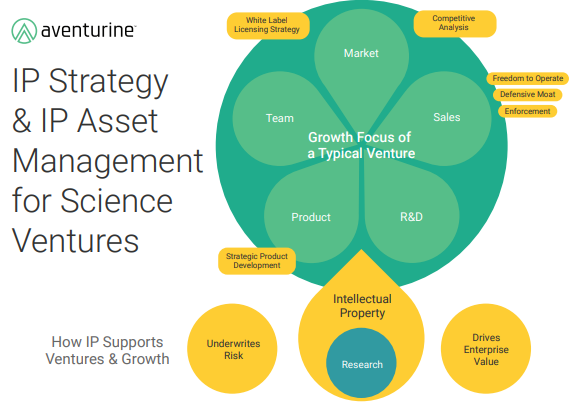

Intellectual Property (IP) Strategy & IP Asset Management for Science Ventures. IP Supports Ventures & Growth

A well-designed & executed IP Strategy can mitigate risk and drive enterprise value throughout the lifecycle of the IP. Managing IP is highly specialized and resource intensive. It’s difficult to justify the cost to bring relevant expertise in-house. Similar to investment banking or property management for commercial real estate, it can be valuable to leverage outside experts to manage your IP for optimal results (protect research and provide value to Inventors & Investors).

David Van Wie

Founder & Chief Investment Officer, Aventurine Capital Group, LLC and Stan Hanks, General Partner, Technology, Aventurine Capital Group, LLC will share their knowledge and experience having sat at every seat of the table of a new venture, as an inventor, entrepreneur, angel investor, venture capitalist, private equity manager and witness in patent prosecution. Both men will share with you the challenges they faced during their careers and how you can better protect your research and provide greater value to the inventors and investors of your early stage venture. Corporates can also gain insight into how they can revitalize their existing dormant IP for greater usage and value.

Stanley Hanks

General Partner, Technology

Stan is an experienced technologist and metrics-driven executive, with deep expertise in commercialization of emerging technologies, and in the accompanying regulatory and financial arcana. With a career ranging from individual contributor to startup founder to Fortune 100 executive, plus operational experience in private equity and as an institutional investor, he brings a wealth of experience to any conversation involving new ventures. Stan has been founder or key man in 14 startups, with 9 exits including 5 IPOs. As a PE operator, he acquired 9 entities and conducted four divestitures. As an institutional venture investor, he made 8 investments totaling over $85M, with four exits including one IPO, and several more still in play. Stan also served as a faculty member at Rice University and Baylor College of Medicine, was the technical director of the W.M. Keck Center for Computational Biology; led the tech transfer office at Baylor College of Medicine; and was a key engineering lead for the first commercial PET scanner. In recent years, he originated a Series C investment in AbSci, a biotechnology company in Vancouver WA, and closely evaluated several other biotech investments. He joined Aventurine in 2019.

For more details, please click on: https://site.ieee.org/scv-yp/startup-sig

www.aventurine.com